Most SaaS companies don't think they have a feedback problem. They run surveys, record calls, collect customer tickets, and hold periodic QBRs. From the outside, it looks like they're listening.

Yet, when we surveyed more than 150 B2B SaaS companies, only 11% said they truly understand their customers' needs — and 41% openly admitted they routinely miss valuable insights.

The problem isn't effort. It's fragmentation.

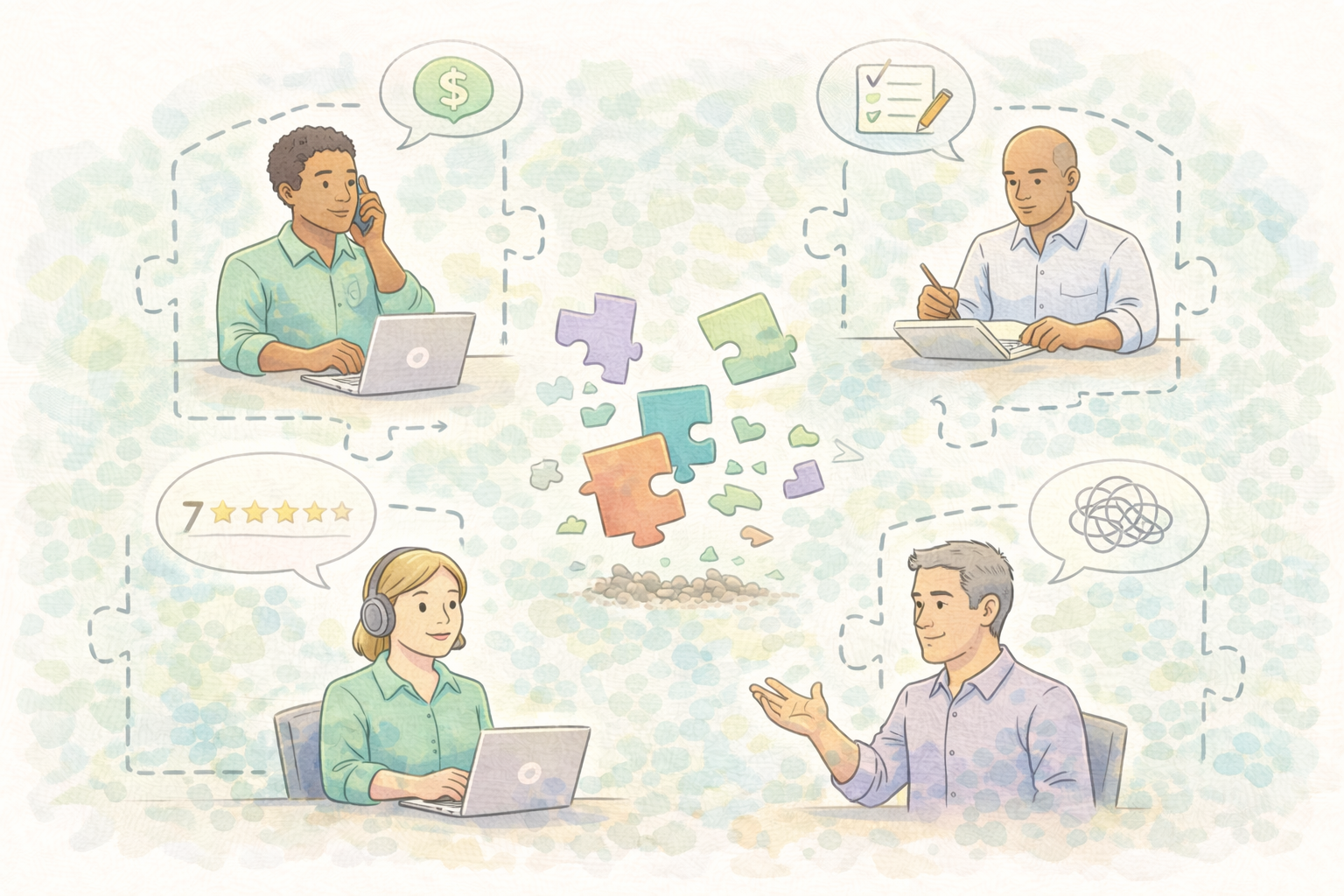

In most organizations, customer feedback flows into the company from dozens of channels, but rarely gets synthesized or shared across teams. Sales hears one version. Customer Success hears another. Product might catch fragments if someone remembers to forward an email. Executives? Often months away from hearing it, if they hear it at all.

This fragmentation is more than just a workflow issue. It's a performance issue.

Our data shows that companies with fragmented, immature feedback loops systematically underperform. They miss early churn signals. They over-invest in the wrong features. They discover expansion opportunities late — if at all.

Consider what happens in practice.

A Customer Success Manager notices customers expressing frustration about a new product feature. The feedback sits in notes or gets mentioned during a 1:1. Weeks later, Sales hears from a prospect who chose a competitor because of that very issue. Product, unaware, continues building on top of a feature customers already resent. The CEO, in the next board meeting, is caught off guard by unexpected churn numbers.

This isn't hypothetical — it's a pattern we saw repeated across companies stuck in what we call the "emerging" feedback maturity stage. These companies have pockets of feedback but lack the systems to consolidate, analyze, and act on it fast enough to make a difference.

In contrast, companies with mature, systematic feedback loops don't just collect more data — they make feedback actionable.

They analyze every customer touchpoint — calls, emails, tickets — continuously. They get real-time visibility into issues while they are still solvable. They align feedback directly to KPIs like Net Revenue Retention and product roadmap priorities.

The result? 66% report improved customer satisfaction, and 83% report increased upsells.

What's remarkable isn't that these companies have more data — most SaaS companies already sit on piles of data. The difference is they've built processes and invested in customer intelligence AI to connect the dots and act faster than competitors.

AI with customer context enables teams to unify signals across CS, Sales, and Product, making churn prediction and upsell identification far more reliable.

If you're a CEO, you might assume your teams are already listening to customers — but if feedback isn't systematically shared, analyzed, and acted on, you're running on intuition more than intelligence.

In an era where switching costs are lower and capital is more expensive, the companies who fix this — who close the feedback-action gap — will be the ones who keep customers, grow accounts, and pull ahead.

The question isn't whether you collect feedback — it's whether you actually use it.